Most finance courses begin by discussing the “time value” of money – the idea that a dollar today is worth more than a dollar a year from now. The explanation they usually provide is: People can invest money to earn interest. In other words, money is worth more today than in a year from now because…well, people can make money from it! This is the economics equivalent of saying the chicken crossed the road to get to the other side. It’s true, but it does not actually answer the underlying question. Why are people willing to pay more for a dollar today than a dollar one year from now?

Before we get to the time aspect of the question, let’s recall why a dollar is worth anything in the first place. Simply put: you can buy things with it! How much can you buy? One dollars’ worth. Now, there are many factors that can influence what sort of ‘things’ one dollar can buy, but, for our purposes, that’s all we need to know. What’s more important to consider here is when you can buy one dollar’s worth of things.

Dollars today vs. dollars tomorrow

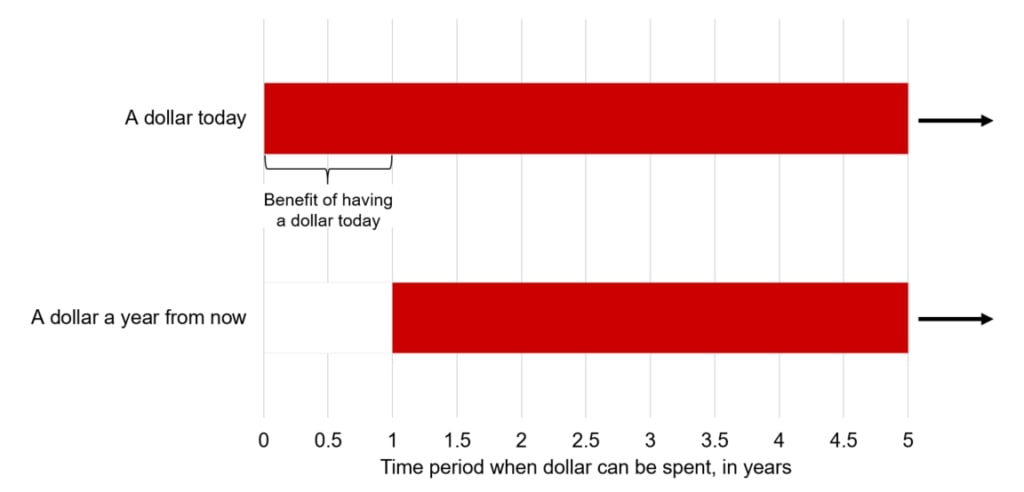

Suppose I give you a dollar today. When can you spend it? You can go out and buy something for a dollar immediately, or you can hold on to the dollar and spend it tomorrow, next month, next year, or next decade if you choose. What happens then, if I give you a dollar a year from now? When could you spend that dollar? You can spend it exactly one year from now when you receive it, or you could hold onto it and spend it one year and one week from now, or one year and one month from now, and so forth. What is certain though, is that you could not spend it during the period from now until you receive the dollar a year from now.

This is why a dollar today is worth more than a dollar a year from now. You can spend the dollar you get today from today until a year from now.

Using the time value of money framework

“Finance is the exchange of dollars that can be spent today with those that can only be spent in the future.”

Other factors impacting interest rates besides the time value of money

There are other factors that influence interest rates we can bolt onto our simple framework. The first factor is storage costs. We’ve assumed so far that it is free to hold onto money from one day to the next. This is not always the case. Large quantities of money can take up space, be damaged by weather or fire, or be stolen. People pay banks to store their money safely, sometimes for fees, but mostly by allowing the bank to profit by loaning out their savings. Storage costs reduce the effective interest rate savers receive.

Credit risk is another factor impacting interest rates. Lenders don’t always know whether a borrower will actually return their dollar in the future. Therefore, lenders request additional interest from less-creditworthy borrowers to compensate for the additional risk. Finally, inflation is another important factor affecting interest rates. The things your dollar can buy today may be very different from the things your dollar can buy a year from now if the value of money changes over time. When lenders expect the value of money to decrease over time, they demand a higher interest rate to compensate for the decline in the value of money.

Note that the value of money changing over time (inflation / deflation) is different from the time value of money. The time value of money is completely due to the ability to spend money now versus the future, whereas inflation occurs when the value of money itself changes.

Conclusion

The time value of money may seem like a simple concept, but it is not. Many ancient societies banned charging interest on loans because they thought it was immoral to demand the borrower return more than what was initially borrowed. Even today, many students first explain the time value of money in terms of risk and inflation. Overall, we hope this explanation clarifies a key concept in finance and provides a simple framework to build upon when trying to understand financial transactions.

Have other economics questions you’d like us to investigate? Feel free to email us at [email protected].