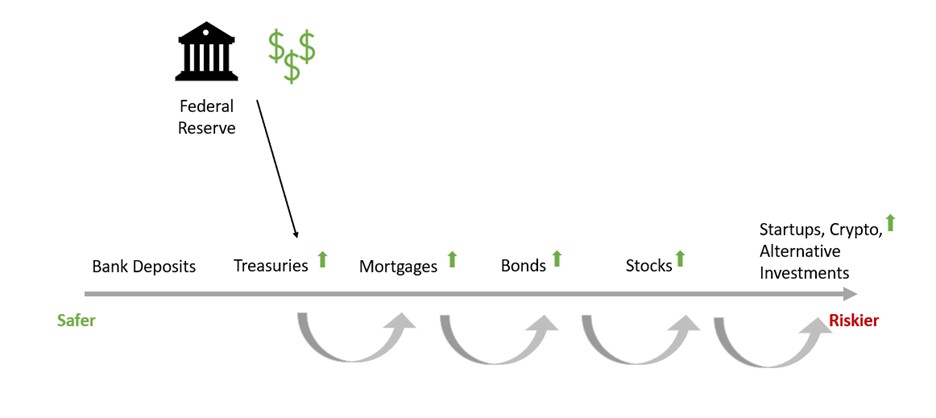

In a previous post, we discussed how the Federal Reserve prints money to buy assets during periods of economic uncertainty. In doing this, the Federal Reserve sometimes buys so many assets that investors have trouble finding things to invest in. By squeezing investors, the Federal Reserve pushes them to make riskier investments, which helps people seeking to borrow money. In this article, we will take a look at some of the potential problems of Federal Reserve policy.

In particular, the Federal Reserve’s operations can cause:

· Inflation

· Investors to invest in risky assets

Monetary Policy Can Cause Inflation

Given the size of the Federal Reserve’s actions, you may be wondering: won’t printing tons of money cause inflation? And, if so, shouldn’t inflation be 100% (how much money the Fed printed since COVID) instead of 9%, like it is today?

Official Inflation Measures Do Not Include Assets

In short, it does cause inflation.

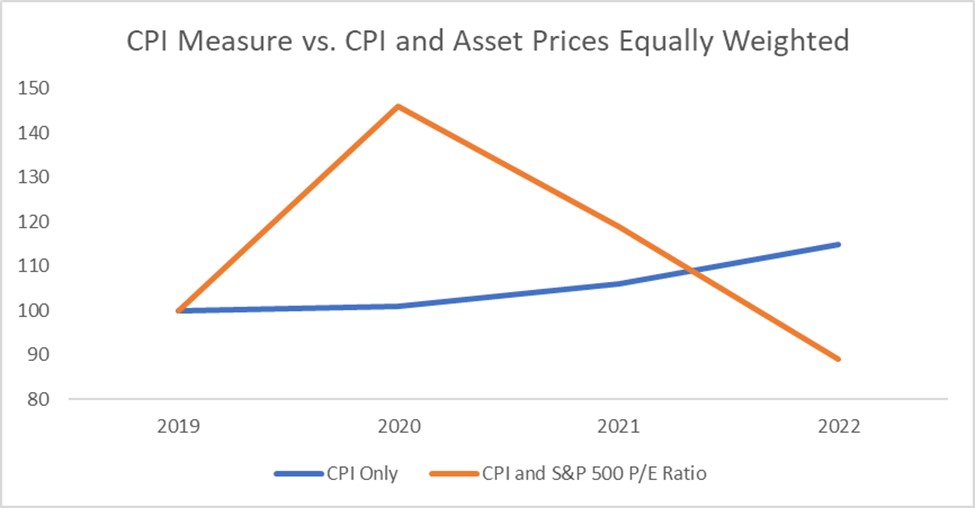

Currently, the measure we use for inflation is the Consumer Price Index (CPI). The CPI measures changes in prices for things the average person buys every day, like food, gas, cars, and rent.

Critically, the CPI does not measure changes in asset prices. So if you could buy a stock last year for $100 and be paid out $3 for the dividend, and that same stock with the same $3 dividend is now selling for $200—the CPI won’t change at all.

The CPI doesn’t include assets for good reasons. As we know, asset prices can fluctuate depending on the emotions of investors. Since we use the CPI to adjust things like Social Security payments, officials worry about tying important services to a measure that fluctuates too often.

But the full basket of goods, services, and assets does rise in price, often dramatically, when the Fed tries to prevent a downturn. So you do experience inflation, regardless of how it is measured.

If assets were included in the CPI, the inflation measure might look something like this:

The Printed Money in Asset Markets Starts to Trickle Out

Over time, inflation doesn’t stay confined to assets. It begins to affect everyday products as well. We don’t immediately notice it because it tends to affect different geographic areas more quickly than others.

For example, say that the Federal Reserve’s operations cause investors to invest in more risky ventures.

Some of those ventures could be, say, tech startups in Silicon Valley. As a result of the increased investments and the demand for workers at these startups, salaries, rents, and the general costs of goods go up as dollars pour into the area.

While inflation starts happening in Silicon Valley, it will take a long time before it affects prices in Detroit, Michigan. Investment dollars need to leave Silicon Valley and settle in the rest of the country to drive up prices elsewhere.

The Government Takes Advantage of Low Rates to Spend Money

Another one of the potential problems with Federal Reserve policy is how it indirectly influences government spending.

Remember that government treasuries represent money the government has borrowed and now owes back to investors. When the Federal Reserve buys up government treasuries, the interest rate the government has to pay to borrow new money goes down.

Because the interest rate is lower, the government can borrow more money, and therefore spend more money. If the government distributes that money quickly to a wide population of its citizens, like it did during the pandemic, then inflation can also rise.

The San Francisco Fed recently attributed 3% of the 9% of inflation we are experiencing today to the COVID 19 relief checks Congress sent out to prop up the economy.

Low Interest Rates Drive Investors into Risky Investments

Besides causing inflation, the Federal Reserve also indirectly push investors into bad investments.

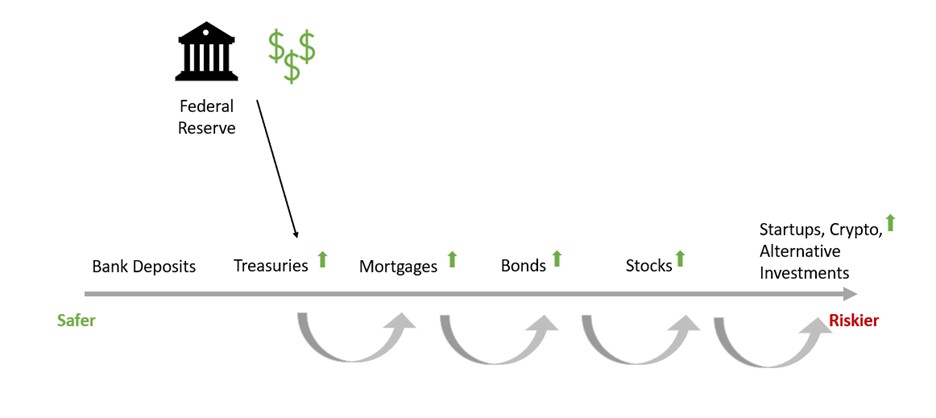

As we discussed in our last article, when the Federal Reserve buys government treasuries, investors take the money they received from selling treasuries and look for something else to invest in. Critically, many investors, such as life insurance companies and pension funds, need to make a certain return on their money to stay afloat. With “safe” treasuries being sucked out of the market and the remaining treasuries thus becoming more scarce and expensive, investors then have to move down the chain of risky investments to get returns on their investment.

In a desperate attempt to keep making money, investors can sometimes overinvest in risky assets, or just overinvest in an asset class in general.

This phenomenon likely occurred before the Great Recession in 2008.

The Federal Reserve left interest rates low after the dotcom bubble burst in the early 2000s. In the face of lower interest rates, investors started “reaching” for returns and dumped money into mis-rated subprime mortgages, borrowers used lower interest rates to buy expensive houses, and construction companies started building many more houses to keep up with the demand.

Consequently, when the Federal Reserve raised interest rates to return them to pre-tech-bubble levels, it exposed the entire industry.

It’s possible the same thing is happening again with this latest bout of lower interest rates. It’s hard not to wonder if cryptocurrencies, which rose almost ten times over the course of the pandemic, are not the latest beneficiary of the Federal Reserve’s actions. Since the Federal Reserve began tightening, cryptocurrencies, like Bitcoin, have now lost almost 70% of their value. Only time will tell if their collapse will meaningfully impact the economy.

Conclusion

To wrap up our Federal Reserve discussion, let’s review three main points on the problems with Federal Reserve policy:

1) Asset prices will dramatically increase when the Federal Reserve tries to save the economy from a recession or depression. When the Federal Reserve unwinds its activities, the stock market may drop even though the economy has improved.

2) The Federal Reserve may cause inflation. That inflation mostly affects the asset market, which is not included in the officially reported inflation measure. Eventually, the inflation may start to affect the price of housing and everyday items.

3) The Federal Reserve may indirectly push investors into bad investments. If a new investment type suddenly becomes all the rage (think housing in the mid 2008s or cryptocurrencies now) and the Federal Reserve has been lowering interest rates lately, these investments might be a consequence of low interest rates rather than sound investment fundamentals. So be wary!

Hopefully, you now understand a little more about how and why the Federal Reserve affects your life. The next time you see the stock market booming while the economy seems bad, you can tell your friends why!