Did you know that the amount of dollars in our economy grew by 80% from 2020 to the end of 2021?

Did you find it strange that the stock market doubled from the start of COVID on March 20th to the end of 2021, despite the entire world shutting down?

In this article, we are going to explain the Federal Reserve’s role in influencing markets. This article is meant for people new to this subject. Our goal is to oversimplify many details to make sure that the reader understands the main point. If you are not new to this topic and are looking for precise details, this article is not for you.

If you take nothing away else away from this article, understand this:

If you see that something bad is happening in the economy (e.g. COVID shuts the world down), but the stock market is skyrocketing—it’s because the Federal Reserve is causing prices to rise on purpose to help the economy. When the Federal Reserve unwinds its activities, the stock market will likely drop, even though the economy may be doing better.

Basic Investment Overview

Let’s start by doing a review of some investment terms. Say you have $100 extra dollars that you would like to invest. You have a few options of where you can invest that money. Collectively, these objects are called assets. When we use the term assets in the rest of this article, we are referring to anything you can invest in—stocks, bonds, houses, bitcoin, collectibles, and so on.

Stocks

If you buy “stock” in a company, you own a portion of the company, which entitles you to a piece of the company’s profits that it pays out to owners (a dividend) and some voting rights. For example, if I bought a share of “Cool Company” for $100 and that company’s dividend was 3%, I’d get paid $3 a year from my share. Based on investors’ future expectations for the company’s dividend, the price of the stock could rise and fall, and I can sell my stock to another investor. Though we typically see people getting excited about rising and falling stock prices, traditionally, it’s really the prospects for the dividend that generates investment returns.

Bonds

If you buy a company’s “bond” with your $100, you loan your $100 to that company. In return, they pay you a “coupon” say 4% (in this case $4) a year for the life of the bond. At the end of the life of the bond, they also pay you your $100 dollars back. So for a 10 year bond, the company would pay you $4 a year for 10 years and give you your $100 back at the end of the 10 years.

Governments also issue bonds to raise money. In the U.S., government bonds are called treasuries and are generally considered safe since the government can always print money to pay them off. Like stocks, I can sell my bonds to other investors at any point, who may value it differently depending on how likely they think the company will keep making payments and not default or go out of business. In general, bonds are considered a safer investment than stocks. As such, their returns are typically lower.

Housing

Not all assets are stocks and bonds. Houses (and the land they sit upon) are one of the largest asset classes in the economy. Like stocks and bonds, you can buy houses in the hopes that the price will rise over time. You can also receive a “dividend” by charging other people rent to live in your house.

Commodities, Bitcoin, collectibles, and other investments

Other things you can invest in, like barrels of oil, bitcoin, and baseball cards, don’t have clear dividends associated with them. But, they are still assets. When you buy bitcoin or baseball cards, you hope that the price will increase. The “dividend” you receive is the amount the price increased relative to what you paid.

The most important takeaway from this discussion is that all of these assets co-exist together competing for investor’s money. If investors have more money to invest and the number of assets stays the same, they will bid up the prices of all assets, from stocks to houses to Picasso paintings. If investors have less money to invest, the price of all assets will fall.

Now that we know what assets are, let’s move on to interest rates. We will discuss what interest rates are, how interest rates affect asset prices, and how the Federal Reserve influences interest rates.

What do we mean by “interest rates”

In general, the term “interest rate” can be used to mean two things.

First, “interest rate” can refer to a specific interest rate for an asset. For example, if I take out a 30-year, $100,000 loan to buy a house, the interest rate might be 5%. Besides paying a portion of the $100,000 back to the bank every year in monthly installments, I also pay an additional 5% charge on top of what I borrowed. That’s an interest rate. When I get paid 2% on my 2-year CD, the 2% I’m paid by the bank is also called an interest rate. In a sense, an interest rate is the fee one person pays to another to borrow their money over a certain period.

Second, you will hear people use the term interest rates (note the “s”). Though an interest rate refers to a specific rate, interest rates generally refer to the overall return an investor can get on their money in the current state of the asset market.

Sound confusing? Let’s break it down.

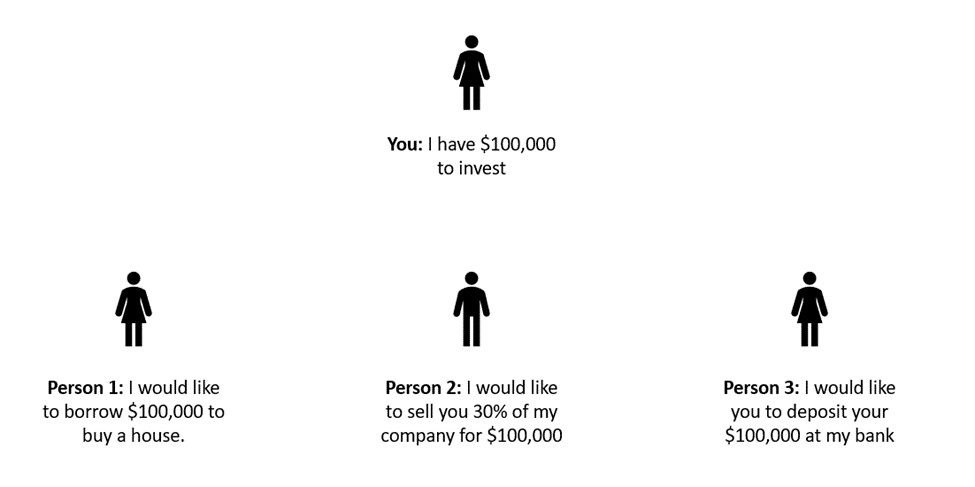

Say you live in a town with 3 other people. You have $100,000 and the 3 other people in the town would like you to invest your $100,000 with them for various purposes. For the sake of the example, assume they can’t get investment money anywhere else.

Since you are the only investor in your town, the three people are willing to give you a high rate of return on your investment, or, as we discussed before, are willing to pay a high fee to use your money.

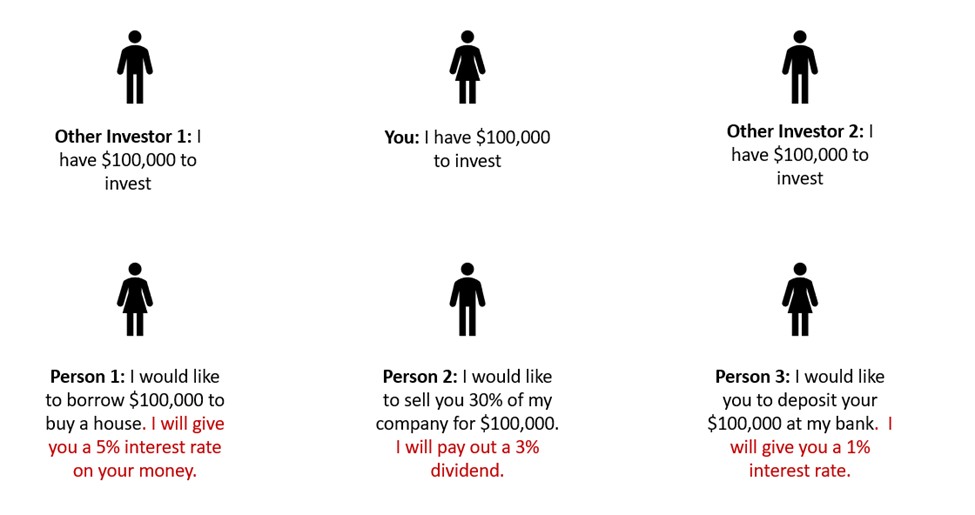

Now picture there were two other investors in your town that were also looking to invest $100,000. Because the townspeople looking for $100,000 now have two other options, they can charge a lower rate of return on their investment, or pay a lower fee to use your money:

In this latest example, we’d say that interest rates have gone down because the overall amount of money you can make on your investment has dropped, regardless of what asset you decide to invest your money in.

Interest rates and asset prices

Remember that assets are tradable. We are used to thinking of people buying and selling stocks, but the same is true of bonds–if you lended a company money in the form of a bond, you can sell that bond to another person, who then collects the coupon going forward for the life of the bond.

The price of an asset, like everything else, fluctuates based on supply and demand. If more people want to invest money, then all the existing assets (stocks, bonds, bitcoin…) will generally go up. If the economy is bad and people are scared to invest money, the prices of those assets generally will go down.

The opposite is true of interest rates, which, if you recall, are just the fees someone must pay to use an investor’s money. The more people that want to invest, the lower the fee someone has to pay to use their money. The fewer people that want to invest, the higher the fee you must pay to use the investor’s money.

So the overall relationship looks like this:

More investment dollars = Higher asset prices and lower interest rates (fees)

Fewer investment dollars = Lower asset prices and higher interest rates (fees)

What does The Federal Reserve do?

The Federal Reserve is a branch of government founded in the early 1900s after a panic nearly took down the American economy. It is currently charged with two missions:

1) Keep prices stable

2) Maximize employment

In short, the Federal Reserve is meant to prevent collapses in the economy. To do so, the Federal Reserve influences interest rates. And to influence interest rates, it prints money to buy assets.

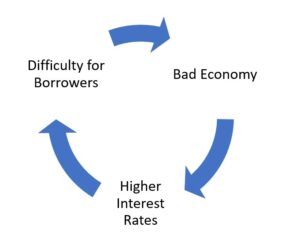

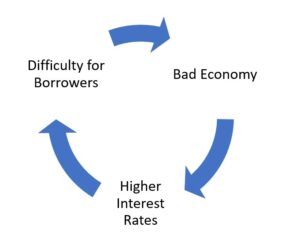

When the economy isn’t doing well asset prices drop and interest rates go up to compensate the few people willing to invest in an uncertain economy.

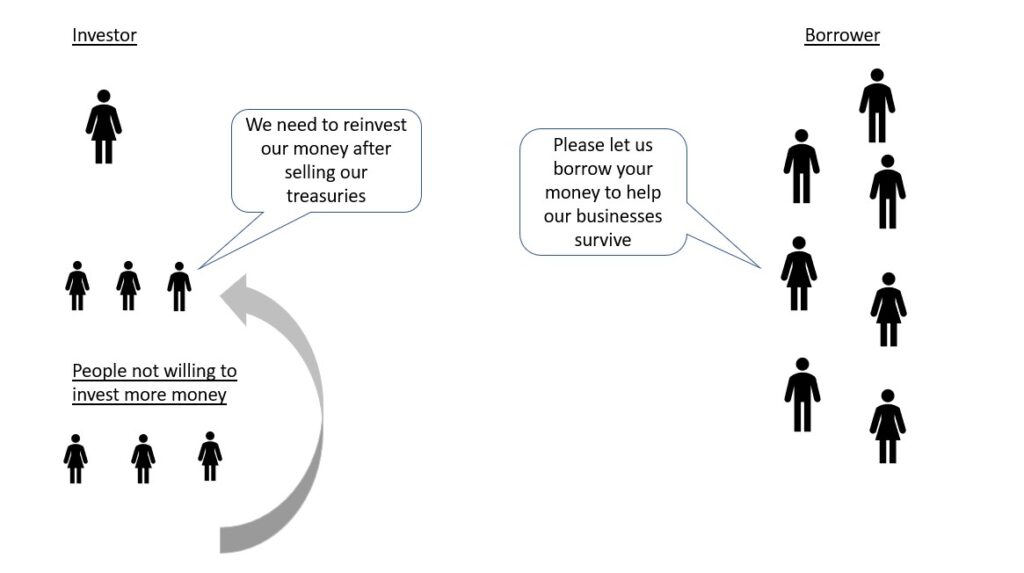

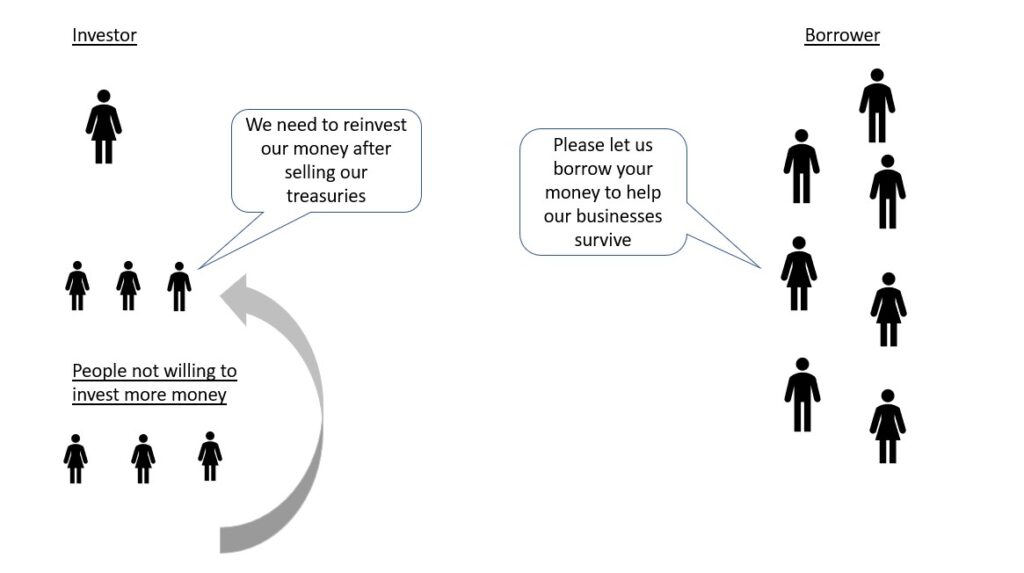

Our investor/borrower picture might look like this:

The problem is that the higher interest rates during bad economic times make it even less likely that borrowers will be able to pay back their loans since they have to pay more money back to the investors. As a result, the economy is hurt even more.

Enter the Federal Reserve.

To help combat the problem, the Federal Reserve steps in as an investor. It starts printing money and uses that money to buy safe assets–typically government treasuries. In this case, “printing money” doesn’t mean printing physical dollars–the Federal Reserve creates the money electronically and uses it to buy the asset. When the Federal Reserve buys an asset from an existing investor, that investor now has cash from the sale that they want to reinvest. Since the Federal Reserve is buying up all the government treasuries, investors are forced to look at riskier options, like bonds for companies, mortgages, and stocks, and reinvest their money there. As a result, all asset prices tend to rise and interest rates tend to fall. With falling interest rates (fees), it is easier for people and companies to borrow money during difficult economic times, which, in turn, helps the economy recover.

Once the economy begins to recover, the Federal Reserve then begins to sell the assets it bought, raising interest rates and taking the money it printed out of the economy again. When the Federal Reserve begins to sell its assets, asset prices are likely to fall even though the economy is stronger.

Scale of The Federal Reserve’s actions

Though the Federal Reserve is always buying and selling assets to influence interest rates, the scale of its operations ramp up dramatically when it looks like the economy is in trouble.

To give you an idea of the size of the Federal Reserve’s actions, here’s a graph of how much the money supply expanded after the Federal Reserve stepped in to combat the economic fallout from the COVID 19 pandemic and the housing market collapse in 2008.

For almost every dollar that existed in the economy at the start of both downturns, the Federal Reserve printed another one. That’s a lot of money in a very short amount of time. As a result of the Federal Reserve taking out assets from the market and pouring dollars into the economy, the stock market can also increase dramatically as a result of the Federal Reserve’s actions. Though the market took longer to rebound after the Great Recession, look how much it increased during the COVID shutdowns.

In short, the Federal Reserve plays a massive role in influencing the price of your assets, and it can cause the markets to move in a way opposite to what you’d normally expect if you just observed the economic conditions of the country. It’s why the market skyrocketed during COVID and it’s why the market is dropping now, even though COVID conditions have been improving.

Conclusion

The Federal Reserve influences interests rates by printing money. In turn, lower interest rates lead to higher asset prices. During times of economic uncertainty, the Federal Reserve lowers interest rates, which can cause asset prices to increase despite a poor economy. In our next article on this topic, we focus on the potential problems with the Federal Reserve’s policy.